Enhancing Customer Experience in Financial Services: The Role of Modern Call Center Solutions

The financial services industry has undergone massive changes in recent years. Customer expectations of banks have evolved, leading to increased competition. Banks need to earn people's trust again. Call centers have emerged to help banks transform the customer experience.

This potential has not gone unnoticed by banking leaders. A survey by Deloitte found that improving customer satisfaction was the top priority for bank executives in 2022. Nine out of ten leaders stated that enhancing the customer experience is vital for driving profits. Call centers are increasingly being seen as the ideal vehicle for realizing this goal.

This blog post will delve into why call centers have become essential for customer experience and growth in the financial sector. We will explore the roles, benefits, and how institutions can optimize their performance through best practices. The significance of integrating call center technology with VoIP will be discussed here. Let's get started!

The Transformational Power of Financial Services Call Centers

Modern financial customers expect personalized service, intuitive interactions, and informed counsel on managing their finances. Modern call center solutions have become instrumental in achieving this goal. By employing the 10 best call center software options available, financial institutions can streamline customer interactions, boost efficiency, and elevate service quality.

These advanced software platforms offer a range of features such as AI-powered chatbots, intelligent routing, and real-time analytics, which enable quick issue resolution and personalized support. Choosing the right technology platform is crucial for running an optimized, compliant, and future-ready financial call center.

Call centers play a pivotal role in understanding customers better and tailoring financial services to individual requirements. They enable institutions to guide customers on spending, saving, investments, and more based on their unique goals. Call centers are the critical touchpoint driving the customer experience transformation within finance.

Why Financial Services Firms are Prioritizing Call Centers

Consumer trust in institutions was eroded by the 2008 financial crisis. Fraudulent activities at large banks were widely reported, leaving people skeptical. As highlighted, financial firms recognize that regaining customer trust hinges on improving the service experience.

Additionally, the rise of digital and app-based neo-banks has intensified competition. Traditional institutions face the risk of customers gravitating towards new-age players. High-end call center solutions enable legacy firms to match the convenience and personalization that neo-banks offer.

Financial services call centers have become vital for retaining existing clientele, winning back trust, and staying competitive in a dynamic landscape.

Key Roles of Financial Services Call Centers

Financial institutions cater to diverse customer needs from simple checking and savings to complex investments and insurance. Call centers serve a versatile role, handling various queries and transactions.

Call centers assist with everyday banking needs like checking balances, processing deposits and withdrawals, and making bill payments. They also facilitate loan applications, mortgage processing, investment transactions, and more specialized requests.

Advanced call routing solutions ensure customers are connected with certified professionals who can provide expertise on niche products. Call centers effectively address a wide range of financial service needs.

Benefits of Implementing a Financial Services Call Center

Implementing a financial services call center can offer a wide range of benefits for both financial institutions and their customers. Here are some key advantages:

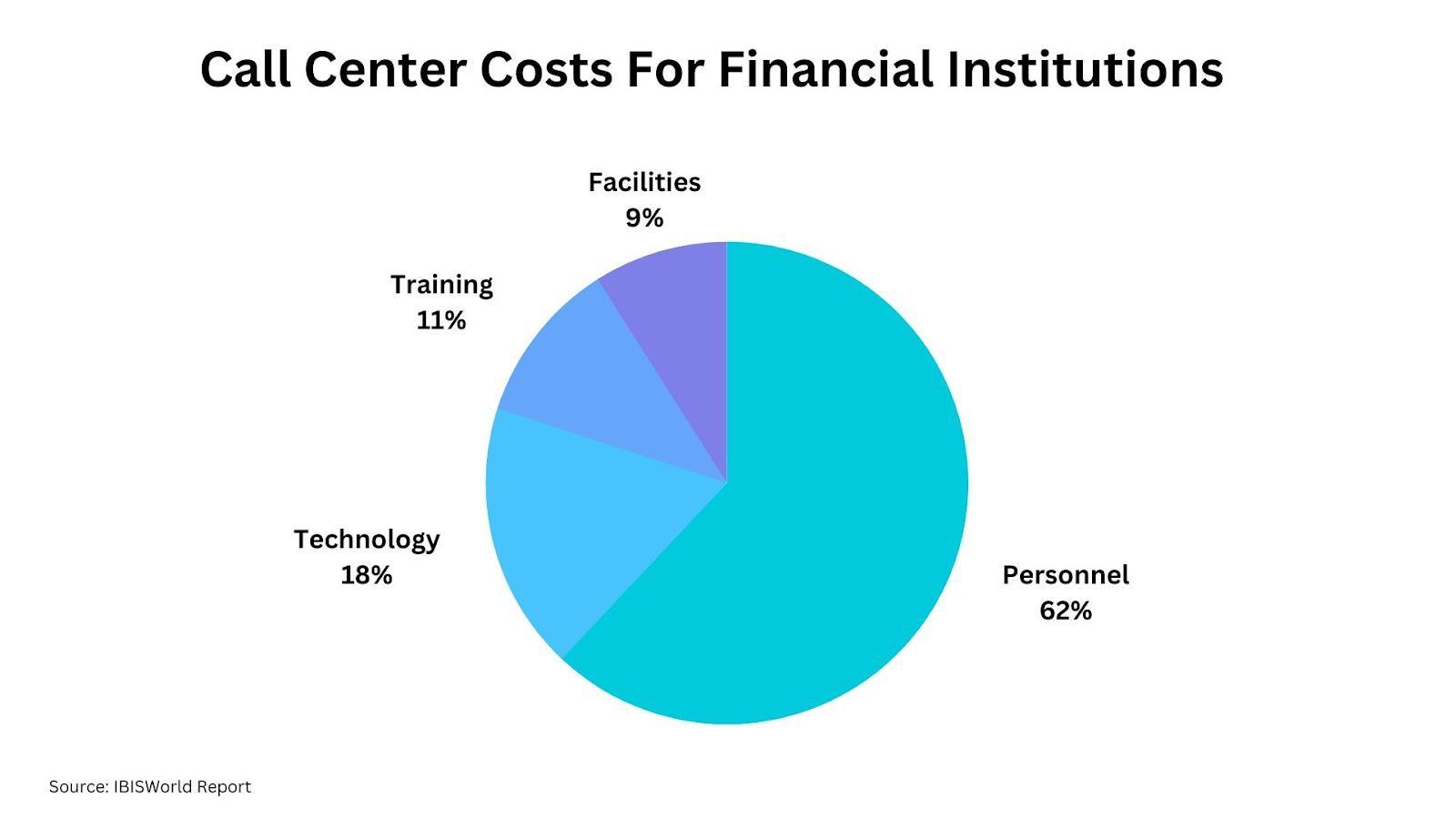

Source: IBISWorld Report

Enhanced Customer Service

Call centers ensure no service opportunity is missed and all customer issues are promptly resolved. Wait times are minimized through efficient routing.

Operational Efficiencies

Cloud-based software reduces overhead costs related to infrastructure and IT management. Call centers boost agent productivity through built-in CRM tools.

Cost Savings

Cloud-based call center software reduces infrastructure and IT costs compared to on-premise systems. Resources can be optimized based on changing demand.

Global Reach

Institutions can easily establish toll-free numbers and serve international customers. Cloud solutions allow complying with regulations across geographies.

Scalability

Call center systems scale seamlessly to handle sudden spikes in call volumes during tax seasons, market volatility, new product launches, etc.

Self-service

IVR and speech recognition enable customers to quickly access account information and complete transactions without agent assistance.

Modern call centers provide financial firms with enhanced customer experiences alongside operational efficiencies.

Incorporating a financial services call center as part of your customer service strategy can lead to improved customer experiences, operational efficiency, and business growth. It's a valuable investment for financial institutions looking to stay competitive in a customer-centric industry.

Best Practices for Optimizing Financial Call Center Performance

Leading financial institutions follow several best practices to maximize call center success:

- Recruit specialized agents with extensive product knowledge and advisory skills. Prioritize candidates with financial certifications.

- Conduct rigorous new hire training on products, compliance, soft skills, and call center systems. Maintain ongoing training programs to stay updated.

- Implement AI-enabled call routing to seamlessly direct customers to the optimal agent or self-service option.

- Integrate call analytics to identify opportunities to improve first-call resolution rates.

- Standardize workflows within call center software for efficient ticket handling and information access.

- Enable remote work to expand the talent pool and build staffing flexibility.

- Adopt cloud-based software for resilience, scalability, and lower TCO compared to on-premise systems.

- Integrate VoIP capabilities to unify call center operations with broader telephony infrastructure.

- Maintain robust compliance across security, privacy, and financial regulations through control features.

- Monitor performance metrics such as customer satisfaction, handle times, and sales conversions to refine operations.

By following these best practices, financial institutions can optimize efficiency, compliance, and service quality across call center interactions.

The Significance of VoIP Integrations in Financial Call Centers

Integrating call center platforms with Voice over Internet Protocol (VoIP) phone systems enhances capabilities through:

Unified administrative interface: VoIP systems integrate into call center software for easier configuration of call handling and IVR flows.

Enhanced call information: Caller IDs, dialed numbers and other data seamlessly pass between the VoIP system and call center application.

Flexible scaling: Cloud VoIP systems sync with call center platforms to easily scale capacity.

Omnichannel integration: VoIP systems interconnect call center software with CRM solutions for unified customer experiences.

Integrating VoIP telecom capabilities amplifies the functionality of call center platforms.

FAQs

How do financial call centers ensure compliance with regional financial regulations?

Financial call centers implement robust compliance protocols covering data security, recording disclosures, consumer privacy practices, and advisor licensing requirements. They conduct ongoing training on the latest regulations and leverage call center software features to enforce compliant workflows.

What are the key features to look for when choosing software for a financial institution?

Essential features include call recording, PCI compliance, advanced call routing, IVR, omnichannel support, robust reporting, workforce management, and the ability to handle financial transactions. Cloud-based systems offer easy scalability to manage peaks and valleys.

How do modern call centers handle the challenge of serving customers across zones?

Call centers leverage cloud software’s global connectivity to establish toll-free numbers worldwide and recruit multi-lingual agents. Intelligent call routing directs customers to appropriate agents based on language, time zone, and availability. Translation services also help bridge language gaps when needed.

Modern call center technology has transformed the financial sector by enabling more convenient, personalized, and on-demand customer experiences. As competition intensifies, these agile hubs will be integral for financial institutions to retain and expand their customer base through exceptional service. Integrating the latest call center solutions is key for forward-thinking financial firms looking to thrive in the next era of banking.

-

Recent Posts

-

Related Stores

-

Offers Related to This Blog